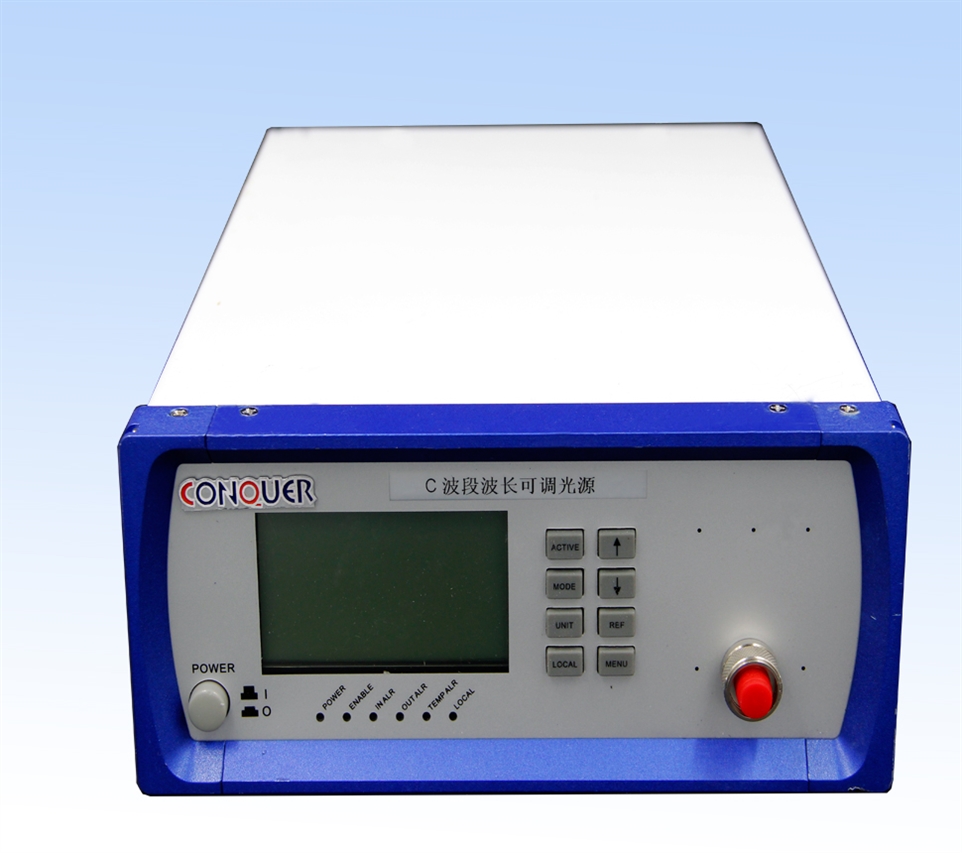

In contrast to many laser classes, tunable lasers offer the ability to tune the output wavelength according to the use of the application. In the past, tunable solid-state lasers generally operated efficiently at wavelengths of about 800 nanometers and were mostly for scientific research applications. Tunable lasers typically operate in a continuous manner with a small emission bandwidth. In this laser system, a Lyot filter enters the laser cavity, which rotates to tune the laser, and other components include a diffraction grating, a standard ruler, and a prism.

According to market research firm DataBridgeMarketResearch, the tunable laser market is expected to grow ata compound annual growth rate of 8.9% during the period 2021-2028, reaching $16.686 billion by 2028. In the midst of the coronavirus pandemic, the demand for technological development in this market in the healthcare sector is rising, and governments are investing heavily to promote technological progress in this industry. In this context, various medical devices and tunable lasers of high standards have been improved, further driving the growth of the tunable laser market.

On the other hand, the complexity of tunable laser technology itself is a major obstacle to the development of the tunable laser market. In addition to the advancement of tunable lasers, new advanced technologies introduced by various market players are creating new opportunities for the growth of the tunable lasers market.

Market type segmentation

Based on the type of tunable laser, the tunable laser market has been segmented into solid state tunable laser, gas tunable laser, fiber tunable laser, liquid tunable laser, free electron laser (FEL), nanosecond pulse OPO, etc. In 2021, solid-state tunable lasers, with their broader advantages in laser system design, have taken the number one position in the market share. On the basis of technology, the tunable laser market is further segmented into external cavity diode lasers, Distributed Bragg Reflector lasers (DBR), distributed feedback lasers (DFB laser), vertical cavity surface-emitting lasers (VCSELs), micro-electro-mechanical systems (MEMS), etc. In 2021, the field of external cavity diode lasers occupies the largest market share, which can provide a wide tuning range (greater than 40nm) despite the low tuning speed, which may require tens of milliseconds to change the wavelength, thus improving its utilization in optical test and measurement equipment.

Divided by wavelength, the tunable laser market can be subdivided into three band types < 1000nm, 1000nm-1500nm and above 1500nm. In 2021, the 1000nm-1500nm segment expanded its market share due to its superior quantum efficiency and high fiber coupling efficiency. On the basis of application, the tunable laser market can be subdivided into micro-machining, drilling, cutting, welding, engraving marking, communication and other fields. In 2021, with the growth of optical communications, where tunable lasers play a role in wavelength management, improving network efficiency, and developing next-generation optical networks, the communications segment occupied the top position in terms of market share.

According to the division of sales channels, the tunable laser market can be divided into OEM and aftermarket. In 2021, the OEM segment dominated the market, as purchasing laser equipment from Oems tends to be more cost effective and has the greatest quality assurance, becoming the main driver for purchasing products from the OEM channel. According to the needs of end users, the tunable laser market can be segmented into electronics and semiconductors, automotive, aerospace, communications and network equipment, medical, manufacturing, packaging and other sectors. In 2021, the telecommunications and network equipment segment accounted for the largest market share due to tunable lasers helping to improve the intelligence, functionality and efficiency of the network.

In addition, a report by InsightPartners analyzed that the deployment of tunable lasers in the manufacturing and industrial sectors is mainly driven by the increased use of optical technology in the mass production of consumer devices. As consumer electronics applications such as microsensing, flat panel displays and liDAR grow, so does the need for tunable lasers in semiconductor and material processing applications. InsightPartners notes that the market growth of tunable lasers is also impacting industrial fiber sensing applications such as distributed strain and temperature mapping and distributed shape measurement. Aviation health monitoring, wind turbine health monitoring, generator health monitoring has become a booming application type in this field. In addition, the increased use of holographic optics in augmented reality (AR) displays has also expanded the market share range of tunable lasers, a trend that deserves attention. Europe's TOPTICAPhotonics, for example, is developing UV/RGB high-power single-frequency diode lasers for photolithography, optical test and inspection, and holography.